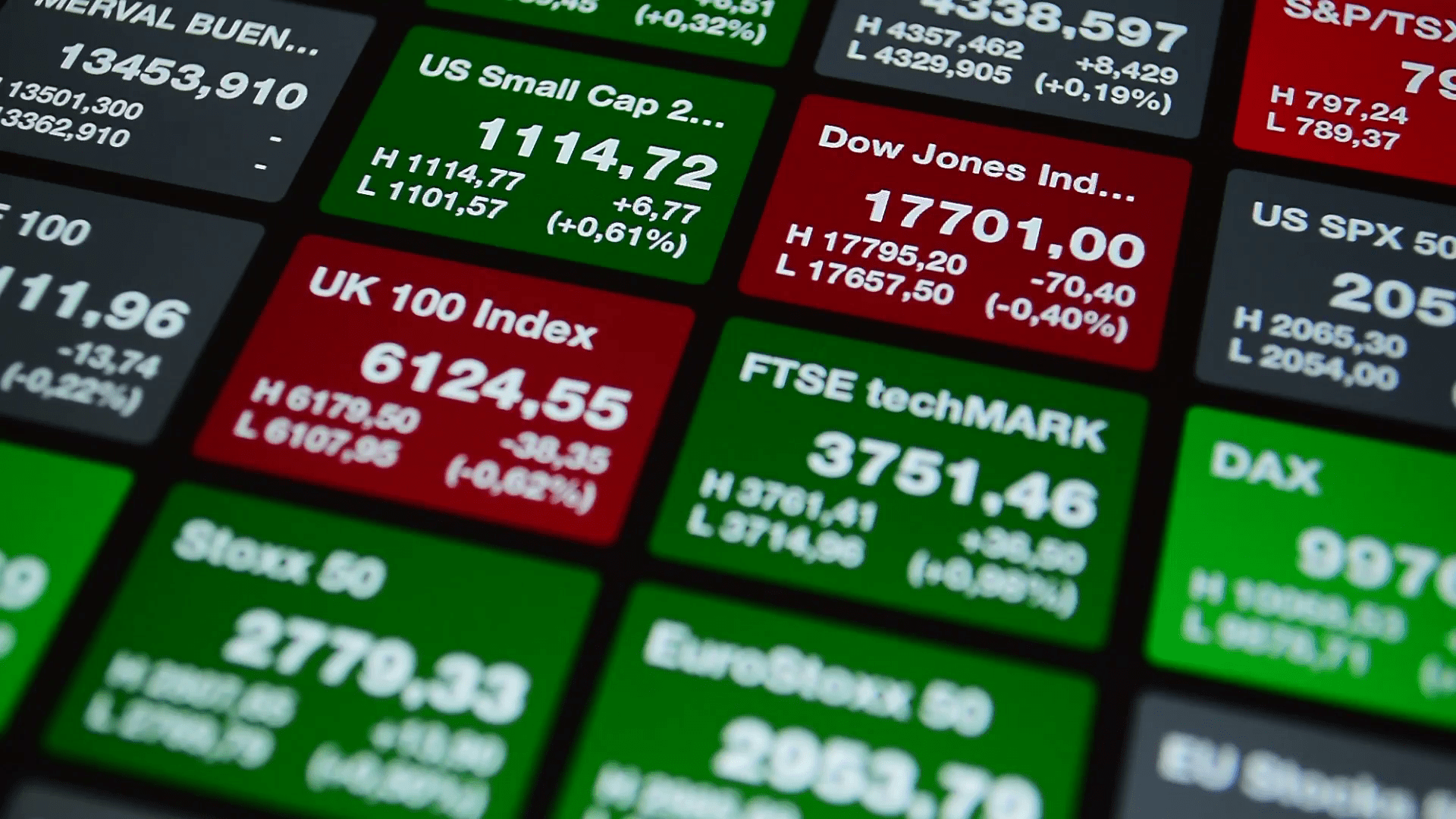

A New Way to Trade US and Global Stock Indices

Feel limited by “buy and hold” investing? Frustrated by seeing your portfolio go up one month and down the next? Looking for a way to actively trade the markets, not just invest long-term?

With the security of limited risk and a regulated exchange, trading the short-term movements of the stock market can be a source of pleasure as well as profit. Binary options and spreads open the stock index futures markets to individual traders with low costs and limited risk, opening a world of opportunities.

Stock Index Futures onFidelity Trust Trade: A World of Opportunity

OnFidelity Trust Trade you can trade binary option and spread contracts based on the underlying futures prices of the following stock indices from the U.S. and the rest of the world.

UNITED STATES:

Wall Street 30

Dow: Based on CBOT E-mini Dow® Index Futures, tracking the performance of 30 major U.S. companies

US 500

S&P 500: Based on CME E-mini S&P 500® Index Futures: 500 large-cap common stocks on the NYSE & Nasdaq.

US Tech 100

Nasdaq: Based on CME E-mini Nasdaq 100® Index Futures, tracking 100 leading non-financial U.S. companies.

US SmallCap 2000

Russell 2000: Based on CME E-mini Russell 2000® Index Futures, tracking 2000 small-cap U.S. equities.

REST OF THE WORLD:

China 50

China A50: Based on SGX FTSE Xinhua China A50® Index Futures: 50 firms on the SSE & Shenzhen exchanges.

FTSE 100

FTSE 100: Based on Liffe FTSE 100® Index Futures, tracking the largest 100 UK companies by market cap.

Germany 30

DAX: Based on Eurex DAX® Index Futures, 30 major German companies on the Frankfurt Stock Exchange.

Japan 225

Nikkei: Based on SGX Nikkei 225® Index Futures, tracking the activities and sentiment of the Japanese stock market.